Whoa! It finally happened. I had an investment 10x for the first time in my life, and the crazy thing about it is that it happened in just a few months. Now I’m not writing this article to brag, or make you feel bad for missing out or anything like that. I’m writing this as an example of what is possible if you start investing.

I started investing for the first time last year when the stock market fell off a cliff. I figured it would likely go back up, decided to get in while it was low not knowing really what the hell I was doing, and it’s been a fun ride since.

As you’re probably aware, last year was a great time to get in the stock market. Plenty of stocks that dropped right after the pandemic started went back up faster than ever. In fact, if you got in then there is a good chance that you could have had a 10x investment yourself.

But, that’s all over with. We’re no longer shooting fish in a barrel.

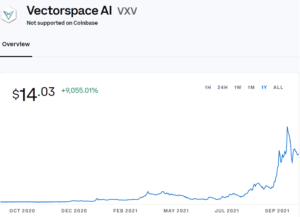

Yet, I was able to have my first 10x investment in 2021. What is it? VXV aka Vectorspace AI. It’s a cryptocurrency token. Vectorspace is a project that specializes in on demand matrix correlation datasets.

I bought into VXV starting around $.80, bought some more around $1.70, and then when it dipped around $1.30 or maybe 1.40 I bought some more. My average buy price is probably somewhere between $1.30 and $1.40, I don’t know the exact price I bought at. But today, as I write this it’s sitting right at $14.

Now, I’m not going to specifically go into what VXV does and all about their specific project. However, I do want to talk about how you can find your first 10x investment. Or possibly another 10x investment.

That being said, before we do, I need to let you know that none of this is financial advice! This is simply just my opinion on a specific way of investing. In the end, I could be wildly wrong about all of this.

So far though investing has paid off for me. Not always, but overall it has paid off in the short term.

Where Can You Find a 10x Investment?

Well, it’s pretty simple really. If you want to find a 10x investment, then you need to invest in things that are riskier plays. You can’t really have it both ways.

Investing in Amazon is great, and it’s likely a quality long term play, but at this point with Amazon’s 1.6 trillion dollar market cap, it isn’t a company you would invest in expecting to get a 10x return anytime soon.

Something like that is a safe investment, but you’re not getting a 10x anytime soon.

Nothing controversial about that.

So where do we find these 10x investments?

Well, we want to find Amazon before the rest of the world knows about Amazon. That’s what you have to do. Much easier said than done.

But, this mean market caps matter. Going from a 1 billion dollar market cap to a 10 billion dollar market cap is easier than going from 10 billion to 100 billion.

However, more risk right? Exactly.

Market cap isn’t everything though. If a 10 billion dollar market cap stock/crypto is going to continue to grow then 100 billion isn’t out of the question.

It’s all about picking the right project to invest in.

So where do I personally think these investments are most likely to be found?

Cryptocurrency.

A few months ago I wrote about how I had put a lot of money and even sold investments in order to move more of my portfolio over to cryptocurrency.

This is when Bitcoin had basically halved. There was a massive selloff and to me this looked like the perfect opportunity to get into crypto.

I “bought the dip” and continued adding money in while it was on it’s way down to just under 29k. It now sits at around 43k (after recently hitting about 52k).

Now Bitcoin hasn’t 10x’d since then, hell it hasn’t even 2x’d. But you know what has? Plenty of “alt coins”.

And this my friends, is where the huge upside 10x potential is waiting.

Again-just my opinion, not financial advice.

I used to have some small market cap stock investments and I’ve sold off most of these investments. As for stocks, I like to stick to the safer bets, because if I’m shooting for the moon, then personally I think crypto is where it’s at.

VXV is a very small market cap.

In other words, crypto is already considered a riskier investment. So this is risky within risky.

Or is it? If crypto is the future then there is opportunity here that you won’t find anywhere else.

Now I’m invested in a few smaller alt coins and VXV just so happens to have moved up as one of/if not the largest investment I have. Simply because of the fact that it has 10x’d. In fact, I could have sold it at about $19 because that was the high it hit before it had a bit of a selloff.

And trust me, I thought about selling around that price. Whenever you’re feeling that euphoric then it typically means there is going to be a selloff.

But honestly, with VXV I actually think it could be a 100x investment, not just a 10x investment. Which…means…this…could…be…a…10x…itself…again.

Who knows though.

Like I said, I could be wildly off. It could fall back to $4. Or back to zero. But personally I don’t see this happening.

They Won’t All Be Winners

If you’re investing in these type of investments then you’re likely going to have some losers as well. Full disclosure, I’ve also had a 10x the opposite way. Literally the worst investment of my life.

But, I didn’t put as much in that one, and even if I did I’d still be way ahead.

Let’s look at this way. Here’s a hypothetical.

You put a grand in 4 different investments, and let’s say only 1 of these 4 takes off while the others fall off. Where does that put you?

We’ll assume a 10x up on 1, and a 10x down on the other 3.

Investment 1: You turn $1,000 into $10,000.

Investment 2: You turn $1,000 into $100.

Investment 3: You turn $1,000 into $100.

Investment 4: You turn $1,000 into $100.

Initial investment: $4,000.

Ending investment: $10,300.

So with 75% of your investments falling off a cliff you still ended up with a 2.5x assuming one of them 10x’s.

Keep in mind this doesn’t include any gas fees or taxes you have to pay. But still, that’s a nice ROI.

The key is to simply invest in projects that have an actual use case and are actually providing value, create quality partnerships, and have a winning team with a winning strategy.

Credit Where Credit is Due

Now here’s the kicker. I would have no clue about VXV if it wasn’t for some random people on Twitter. That’s right. That’s how I found out about VXV.

To be clear though, I’ve seen hundreds of coins and stocks mentioned on Twitter and most of them get thrown in the garbage bin after taking a look at them.

But, I was able to find VXV this way. I didn’t buy initially, I think I researched it for about a month before I actually went in on it. And now, I’m wishing I had went in even more!

Anyways, as mentioned, credit where credit is due. The 2 people that gave me the most influence and incite into VXV were @Dcrypto25 and @DrDavidClements.

Dcrypto25 has a ridiculous thread on Twitter that really breaks down what VXV is all about, his information is outstanding. And DrDavidClements’s conviction and enthusiasm in VXV is next level.

Both of them are what inspired me to do my full research on VXV and eventually get in on this excellent investment.

A 10x Investment is Incredible

Getting a 10x investment in 5 years is incredible. The fact that I was able to get a 10x investment in just a few months has completely blown my mind. It’s amazing.

Again, I’m just writing this to let you know the possibilities if you get into investing. If you’re sitting on the sidelines and not investing then I can guarantee there is no way you’ll get a 10x.

What about you? Have you had a 10x investment? Do you have investments you think will hit this mark? Do you think it’s too risky? Let me know in the comments below!