Are you wanting to get into cryptocurrency investing for the first time? I’m fairly new to investing myself and been able to knock out plenty of beginner mistakes in my couple of years of investing. I’ve created a beginner crypto investing guide that details risk/reward and various strategies you can apply.

Now, there is a lot of risk in crypto investing so keep that in mind. However, there’s also a ton of potential. Nobody can predict the future so it’s always important to have a plan ahead of time and look at it from all angles.

Before we get into this though, I need to let you know that none of this is financial advice. You need to do your own research. This is just a guide that I follow (and have made adjustments on to my strategy as I go).

We all have different situations and different risk levels etc. so no 2 people will have the same investing strategy. There are so many variables that your situation likely won’t be the same as mine or many others.

That being said, let me explain a bit about my situation and where I’m coming from. This way you can decide if this is even worth reading for you.

I’m not rich, I’m just a regular “blue-collar” American who more less lives paycheck to paycheck like roughly 80% of the country.

I use a strategy of investing as my “3-6 months’ worth of savings”. So my strategy is simply a strategy that many financial advisors don’t even tell you to do.

The standard “financial advice” is to pay off all of your debt and then start investing in things like individual stocks and cryptocurrency (outside of a 401k/IRA etc.) only after that other debt is paid off (besides your mortgage).

Well again, this isn’t financial advice.

But the way I see it, is that for the average person. We’re out losing money to inflation, we’re not getting out of debt any time soon, and had we been investing the last decade instead of paying off additional debt we’d be much better off financially.

And this is where cryptocurrency comes into play. If you bought Bitcoin a decade ago and put in $1,000 it would have made you a millionaire now.

For example, 1 single Bitcoin at that time (January 2012) was fluctuating at about $6 a coin. Now…Bitcoin is worth around $38,000 give or take (it changes quickly).

$1000 invested then would now be worth just over 6.3 million dollars. We all should be kicking ourselves.

But past performance doesn’t equal future performance. Enter risk.

Cryptocurrency investing would fall under the category of “risky investing”. You have to understand that first of all.

Let me give explain specifically what I’m talking about. The upside is that you could invest in coins that 100x in a relatively short amount of time, for example, LUNA did that in about a 1-year stretch in 2020.

However, you could also lose that same amount and put in $1000 to only be left with about $10 or so. High risk/high reward.

LUNA later 1000x’d the other direction…

That’s what we’re looking at here. And when I talk about investing in cryptocurrency, I’m not just talking about Bitcoin, I’m referring to the thousands of other “alt coins” as well, ie LUNA, ETH, etc.

And that is what it boils down to. Is understanding our risk levels and having a gameplan ahead of time instead of acting emotionally.

The way I see it is if you go into crypto investing with a gameplan and stick to that game plan you’re good.

In other words, if you get off of your game plan and it works out and you make money, then you got lucky.

And if you stick with your game plan and lose money, then it was already an understood risk.

Let’s start this with some guidelines.

Top Beginner Crypto Investing Guidelines

1. Don’t FOMO

This is the number 1 rule really. FOMOing aka “fear of missing out”. This is how you get rekt. This is a common theme amongst newbie crypto investors. They get in after things are flying high because they hear about how much money people are making, and shortly after they get in, there is a massive selloff.

If you’re hearing about something after it’s already up, while you can maybe get it half way up or so, the risk reward just typically isn’t there. I If you’re lucky you might see a double of your investment, in which you likely need to sell that.

But there’s also a good chance it falls off a cliff and you lose a lot of money. Don’t do this.

2. Buy Early, or Buy Dips

Duh Mr. Obvious. But for real, beginner investors tend to completely ignore this and FOMO in, so this goes hand in hand with that. With highly volatile investments like crypto. Make it a rule, either buy before something has taken off, or only buy massive dips.

3. Sell Rips

Just as we need to buy low, we need to sell high. You can hold long term if you want, but understand crypto is highly volatile and just as fast as you make it, you can lose it.

You’re not investing in Berkshire stock, this is a volatile space that can make make you rich, or get you rekt quick.

4. Pay attention Daily

Again, you can invest in these long term with the understanding that there will be massive swings up and down in the meantime, but if you care about your money right now, then you might want to pay attention.

These are not “safe investments”, you’re investing in the stock market on steroids…at least that’s how I describe crypto investing. So pay attention, because things can change fast.

One day you’re smiling, the next day you wake up and Bitcoin dropped 20% and your alts dropped 40%. That’s a real possibility. If you are targeting long terms numbers that’s fine as long as you’re willing to lose a lot in the meantime (or make a lot a risk losing what you’ve made).

5. Keep Money on the Sidelines

Having money to buy dips is very important. You can put this into stablecoins if you want as well but not having 100% invested into volatile coins is always a good idea.

This way you can actually buy the dip, and it also gives you a nice idea of the amount you should sell when things are running. A general amount to have on the sidelines would be 25%-75% (more on this below).

6. Stick With Your Plan! Dont’ be Scurd…

Again, it’s easy to get emotional while investing such highly volatile investments. It’s so easy to get down when things are down and be overly confident when things are flying high.

In a general sense, we want to do the exact opposite of this. This is why having a gameplan ahead of time is so important! Pick out buy/sell points and follow through.

Don’t get emotional. Use logic and follow through when it’s time. Buy when you’re scared (if it fits your gameplan) and sell when you’re overly confident (if it fits your gameplan).

7. Don’t Be Afraid to Change Your Opinion

Cryptocurrencies are volatile assets, if you find yourself changing your mind because new information has came to light, then that’s fine.

I realized I was bullish at times where things didn’t exactly feel right, in other words, my gut feeling wasn’t exactly matching what I was hoping to have happen.

While I wanted Bitcoin to hit 80k plus in the last bull market, changing my mind after things had fallen and reallocating based on my confidence levels saved me a lot of money as we went further into a bear market.

Just because you originally had one thing planned out doesn’t mean you can’t be quick to change your mind based on various factors.

Stick with these 7 rules and you’ll be better off than most crypto investors. But let’s talk about all of this into detail.

How Much Money Should You Invest in Crypto?

This isn’t a question I can answer for you. This is where you decide your risk level. But understanding that cryptocurrency is highly volatile will give you a general idea where you should be.

Again, I consider crypto a higher risk investment, however, I love the potential so I’m personally willing to up the risk level.

Some people go all in. That’s not me.

I mentioned I basically invest as 3-6 months of “savings”, you can read more about that here. But for the most part I try to stick to 1/3 “safer” investments, 1/3 medium risk, 1/3 high risk investments but always having cash available as well.

And recently I’ve basically eliminated most “medium risk” assets and have switched to “safe investments” and crypto only.

In other words, this means if your monthly bills are 5 grand a month (including food, gas etc.) then that means I would be willing to invest around 2-10 grand in cryptocurrency, with 30 grand total in stocks and cryptocurrency.

Now this does not include my investments in my 401k etc. which is made up from stock investments, this is another reason why I’m willing to put a larger percentage of investments in crypto. From my overall investments it isn’t actually 1/3, it’s much lower than that.

And this is just a general guideline I use. It doesn’t always work out exactly like this. But that’s my gameplan.

Pick out something that works for you. You may want more or less risk. It’s important to keep in mind your overall net worth when deciding how much you should invest in cryptocurrency.

Depending on your income and risk levels $1,000 could be all you want to invest, or maybe you’re someone who think s$100,000 is something you’re willing to invest. It’s all relative.

Are You Buying Bitcoin, other Alt Coins, or Both?

Again this is going to be determined by your risk level. Bitcoin is a highly volatile investment, but alt coins are even more volatile. It’s important you know previous charts to understand what you’re investing in.

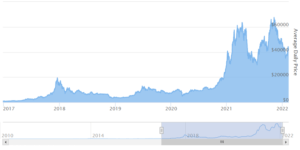

Here’s is Bitcoin:

Per 99Bitcoins.

This is the last 5 years in Bitcoin, as you can see it’s taken off recently, and had a similar take off in 2017, only to drop and then basically consolidate for years.

Here’s what you need to know. Most “alt coins” will run during a bull run and die during a bear run. So in other words, nearly all of them drop 90% plus in value. That’s the risk level you’re looking at with them.

Picture someone swinging a whip up and down (side view), Bitcoin would basically be the person’s arms….alt coins would be the whip. Does this make sense?

Bitcoin is the driving force for basically all alt coins (unless ETH were to overtake BTC). In other words, they go as Bitcoin goes only with much harder swings. This means though there is more risk with alt coins there is also more potential.

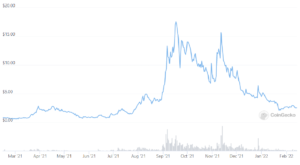

However, we need to understand what we’re dealing with here. Let’s look at an example of a small cap alt coin for perspective:

Per Coingecko

This is the 1-year chart on VXV. This is a small cap coin that I invested in early in towards the middle of the year (June-July)…I even wrote about how I had my first 10x investment with it. Hence, why I’m using it as an example.

I held onto VXV and didn’t sell any of it. Yikes.

I’m still above on it but clearly should have sold the top. This right here is why you need to understand what you’re investing in. Looking at this chart, you can clearly see when buying is a good idea, and when selling is a good idea.

You can see how many people get rekt in crypto by buying after something has been running like crazy only to see it fall off of a cliff.

So to make money from alt coins, you need to also sell on runs. This brings up the next point.

Are You Trading or Hodling?

This will be a big part of what your strategy. Some people just “hodl” their coins as their strategy, and ultimately if you invest in long term winners then the short term doesn’t matter a whole hell of a lot.

But…if you’re investing in alt coins that have taken off, let’s be honest, there is a high probability that they will have massive swings. Kind of like the above example of VXV I used.

With Bitcoin, although it’s volatile, it won’t be nearly as volatile as these. And if you’re invested in highly volatile investments, it makes sense to sell these after they have ran up. That’s the logical thing to do.

And, it’s nearly impossible to pick the top. That being said, a way to look at this is that the more something runs the more risk you are now taking on.

So what are your risk levels?

This being said, we should have a game plan ahead of time. What I’m referring to is specific price points to sell at. 2x then we sell 25%, 4x then we sell another 25%. 6x drop off another 25%. Sell the remaining if it 8x’s.

Obviously these are made up numbers, your price points could be different depending on a multitude of factors.

But just as important as it is to buy low, we need to be taking profits as well. Trust me, it sucks watching all of your gains disappear.

You will sell the next Bitcoin and that’s ok!!!

Once you accept this, it makes complete sense. Look, even if we bought Bitcoin 10 years ago we could have been in the negative for a long time before we saw huge gains.

This is where many people fall into traps. They think they are holding the best thing ever and don’t take any profits.

A strategy I like is that we should take profits, but you can always hold more of your favorite long-term picks.

In other words, with the strategy above where we sell at different price points. With your favorite coins instead of selling 100% you could hold anywhere from say maybe 5-25% depending on your long-term conviction.

This is a strategy I realize I should have been using! I still think VXV may be one of the coins that makes it and ultimately reaches new all-time highs (or not), but in the short term I definitely should have taken some profits.

One of the reasons I didn’t take profits was because of the tax implications, so because I see these factors as being so important to beginner investors (or really anyone), I created a template to track your risk as well as your profits/losses.

This way you’ll know exactly how much cash you have on the sidelines as well as what your tax profits are.

This brings up taxes.

Short Term/Long Term Taxes

There are tax implications for making money on crypto. Yeah, I know, it sucks. But it’s the reality.

Your tax rates will vary quite a bit depending on various factors, but you will likely pay far more taxes if you sell for “short term gains” vs holding for a year or longer.

I’m not sure the exact numbers for myself (I’ll update with more clarification) but as a general estimate it’s something like 15% for long term gains and 30-35% for short term gains.

So that means if you make $1,000 in crypto you’ll only bring home about $700 of that if you sell in less than a year.

If you happen to use the strategy I spoke about above, then you’re just going to have to realize this is the cost of playing the game.

This means that tracking your crypto buys and sales would be wise. You can use the template I personally created or you can use something else, either way it’s important to track what you do and to also have a budget you follow that keeps track of your overall assets as well.

What Should Your Crypto/Cash Ratio Be?

I mentioned above it’s always important to keep cash on the sidelines, so for me, when I say I’m willing to invest 10k in crypto…well there’s some caveats to that because again, we want to have some cash on the sidelines to buy dips.

There will always be dips.

So what’s the magic number? Above I mentioned 25%-75%. So in reality it would look more like I have 2.5-7.5 grand invested in crypto and with the remaining funds sitting on the sidelines.

Of course, the idea is to make money though. So in a made up scenario where we just randomly start with 10 grand and have say 5 grand invested in various coins and 5 grand in cash. We obviously want this number to go up…hopefully that 5k turns into 10k and you now have 15k. (Or whatever made up number you use)

So what then? Do we automatically sell in order to get an exact ratio we want? Well that isn’t really logical, but as I mentioned above we need to be taking profits when our coins have ran to specific range we were hoping to hit. If that’s the case then pull the trigger, if not, let it play out.

However, should we always be invested at 50/50? Why did I mention 25-75%? Where does these numbers even come from? I mean if you look at the fact that crypto has been on a down trend for months after Bitcoin hit its all time high of 69k, then you realize this would be over invested the last several months.

In reality we want to be 100% invested at the bottom before it goes up, and 0% invested at the top. I mean that’s what would happen in a perfect world.

But, of course, that won’t actually play out in reality. But here’s what we can do. We can change our allocation depending on our confidence levels.

If we’re buying a dip and have a general sense that there is going to be a relatively quick turnaround then simply place your money with your confidence. 70% confidence means we stay 70/30, but what if we’re starting to feel like things are overheated and a selloff is coming?

Ask yourself what your confidence levels are. If you feel that it’s more likely the market is going to go down then you can simply change your allocation to reflect that.

Again, what’s your confidence? If you’re more so 70% confident the market is about to go down then your allocation should look more like 30/70. In other words with the example of 10k invested, we would have 7 grand in cash and 3 grand invested in different cryptocurrencies.

If you’re mixed on what happens then go 50/50. You don’t have to stay fully invested.

Again, everyone will have different risk levels and strategies to use and this is just my strategy. You could also short the market instead of lowering your allocation (but that’s a whole other article),

But overall, we certainly don’t want to be stuck holding a bag when it drops 70-80%. We should be taking some profits. Nothing goes up in a straight line and even the best projects will have massive pullbacks (especially in crypto).

Summary

All of this boils down to that if you’re a beginner crypto investor, history tells us that you probably won’t do any of these things right and you’ll likely lose money in the short term. However, if you can stick with it and have a well thought out plan then there is a ton of potential investing in crypto, although I personally do consider it “high-risk”.

What about you, are you planning to get started investing in crypto? Did you just recently get started in crypto? Is there anything you would add to this list? Let me know in the comments below!