What is considered a perfect credit score? Does a 760 FICO score qualify as “perfect” credit? The technical answer is that, no, it does not. 850 is the highest credit score you can achieve and 800-850 is considered “excellent credit”.

That being said, 760 will likely provide you all of the same benefits as an 800+ credit score. In other words, you’ll still get approved for all of the same credit lines, and even likely get all of the same rates with a 760-780 FICO score.

That is where we need to be aiming.

A 760 FICO is Actually Perfect Credit

At the end of the day what does it matter if you’re score is 850 or 760 as long as you get lent the same deals? It doesn’t matter.

And trying to hold on to an 800+ credit score could hold you back from applying for credit that could allow you to make a lot of money.

After all, applying for credit can actually hurt your score.

So does holding on to a technicality matter? Well, it doesn’t at this point.

How do we know this?

Because this is what the “experts” tell us, or in other words, the people who decide what to lend.

And sure, maybe market factors can make the exact number here fluctuate a bit, but for the most part 760 seems to be the magic number.

That being said, the range of credit that is typically viewed as “very good credit” is 740-799. So it may even be possible to get all of the best interest rates and approvals at 740, although it could depend on the overall macro economy.

Either way around 740-780 with 760 being the sweet spot is where we really want to aim to get the best rates.

How Can You Get a 760 FICO Score?

If you’re not close to this number it’s probably going to take some time. If you’re above 700 then it may be something you can knock out in a few months or so.

Understanding how your credit score is made up is the first step to getting to a 760+ FICO score.

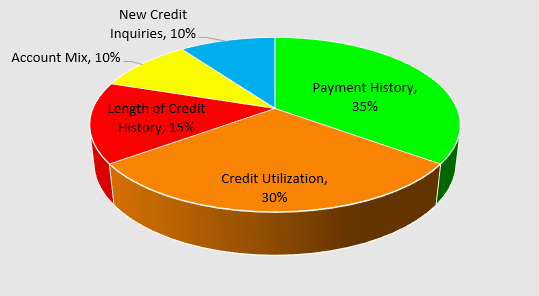

If you aren’t aware, here is the breakdown:

Notice a lot of those things just take time. If you’ve missed payments in the past then there isn’t a whole lot you can do unless you could possibly appeal the delinquency with the debtor. But if you missed payments, all you can do now is continue to make your payments on time.

What are things from this list you can control immediately that could possibly boost your score?

Well again, keep making payments on time obviously.

Focus on Credit Utilization

But credit utilization is the big one. It’s 30% of your FICO score. And the magic number you need to keep this under is 30% minimum if you want to have good credit.

What does this mean? It means if you have 10 grand in credit cards you need to keep your credit balance under $3,000.

This will likely make a huge difference in your score if you can keep it under that mark, and for a 760 FICO score you may very well need to keep this under 10%.

However, if you’re unable to pay down credit cards, what is another way to increase utilization?

By taking out a new credit card.

Now this may or may not be a great idea, and paying off your credit cards is always a good option, but if you can get 0% balance transfers and just send your balance over to a new card this could be another way to improve this number.

So with the above example of having 3k in credit card debt on 10k total of available credit you would have a 30% utilization rate.

What if you just added another credit card?

Say you get approved for a 5k card, you then have a 3k balance with 15k in available credit dropping your utilization rate to 20%. A whole 10% without paying a dime yourself.

I hear from so many people who are trying to build their credit but are afraid to take out any credit.

Look at the breakdown above, does it make sense to worry about a credit inquiry or should you focus first on credit utilization?

This is why it’s so important to know where you’re at in terms of credit utilization, fortunately for you I created a budget template that has a section dedicated just for that, you can read more about that here if you would like.

If not that, then you need to track it yourself or find something to track credit utilization as it is the 2nd biggest factor of your overall score, but something you can immediately change unlike payment history which takes time for it to have a positive impact.

What Can a 760 FICO Score Give You?

The bottom line is that having a 760 FICO scores means you’ll likely get the best rates possible and get approved just as much as someone with an 825 FICO.

This means you’ll just about get approved for any credit card with a high available limit and then the lowest rate on whatever range their APR fluctuates.

This means you’ll get the lowest mortgage rates and will very likely be approved for a mortgage. Same with auto loans or any other installment loan.

The bottom line is that having excellent credit can save you tens of thousands or even hundreds of thousands of dollars in the long run.

And yes, if you’re towards upper echelon of society in terms of wealth then that number will be millions instead of thousands.

Focusing on having an 800+ credit score likely won’t make a bit of difference though.

As this article stated, 760 will likely give you all of the same benefits and is a more realistic FICO score to focus on.

What about you? Do you have a 760 FICO score? Is this a goal of yours? If so, how long do you think it will take you? Let me know in the comments below!