Should you invest in cryptocurrency? Is it the next big thing? Or is it made up monopoly money pretending to be real, leading people on in the biggest ponzi scheme we’ve seen in human history? Big questions to ponder. Many of which we’ll dive into here.

Before we do though, I need to make clear that this isn’t financial advice, and I’m not a financial advisor. All we’re doing here is looking at this from all aspects. Hopefully this gives you some insight into whether you should invest in cryptocurrency, but ultimately you need to do your own research.

Now if we get this answer right, then we can either save ourselves a ton of hardship…or possibly make ourselves wealthier than we’ve been in our entire life. It kind of seems like those are the only 2 options. Who knows, maybe there is a safe middle that this all ends up in, we’ll look at that possibility as well. But first off, here’s what I’ve done lately.

Just over 2 months ago I put out my last article where I briefly spoke about this same topic (hence part 2) and mentioned I had just recently started investing in cryptocurrency. At the time it was a small investment (less than 1% of my net worth). Since then…I’ve massively upped my position. In fact I sold a lot of my stocks and moved them over to various “alt coins”.

Now, my position is about 15% of my net worth (short term). All in just a couple of months. Clearly, you see which side of the table I’m on of the debate. It is, however, important to be completely objective and take emotions out of it. **2022 update-I have drastically reduced my positions while the economy/crypto is not stable**That being said, we need to look at the big picture, understand that crypto is more less high-risk/high-reward investments and to treat it as such.

The Big Picture

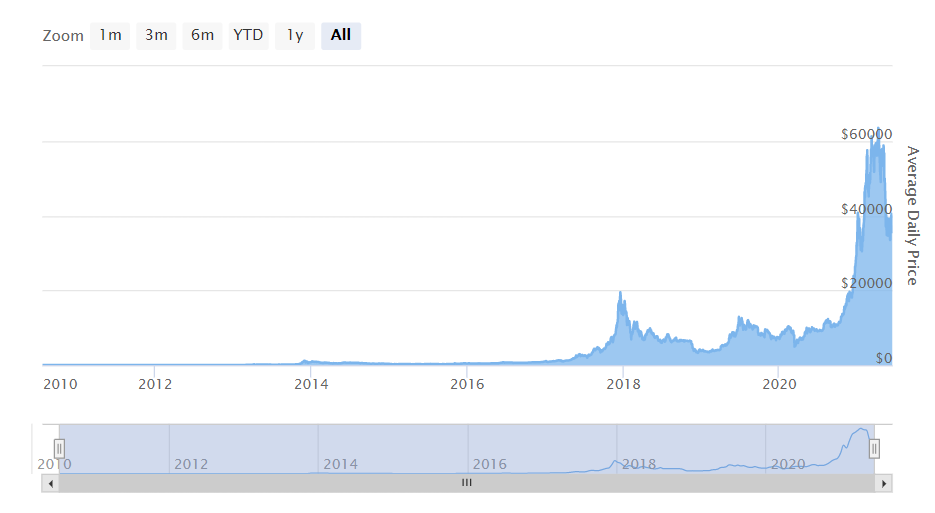

Let’s take a look at Bitcoin’s history. As of today June 30th, 2021, here is Bitcoin’s historical chart:

Per 99bitcoins.com

And if we take a closer look to the 1 year chart, it looks something like this.

Again, credits to 99bitcoins.com.

Hopefully this graph shows you the value Bitcoin has had. Over the last decade it’s been the best investment you could have made on the planet. As we head into July of 2021 let’s take a look back at Bitcoin’s price 10 years ago. Bitcoin traded for $15.40 starting in July of 2011. As of today, June 30, 2021 Bitcoin is trading at $34,210.19 (by the time this is published it may be quite different.)

However, that means if you invested $100 on July 31, 2011 in Bitcoin it would now be worth $222,144.09!!! (Not including taxes, fees, etc.)

The ironic thing about that is that it actually dropped to just over $3 by the end of 2011. So had you put $100 in you would have felt like an idiot for quite a while.

Oh gosh, what if you bought months later when it was going for $3.06? What would that same $100 be worth now? It would be worth over 1.1 million dollars. Yes, that’s correct. A one time $100 investment in Bitcoin at the end of 2011 would have made you a millionaire now.

What were you spending money on around that time? Would you change anything if you could go back in time? LOL.

We all should be kicking ourselves.

But, personally at that time I wasn’t investing in anything. I, like most people, spent the money I earned on things that I mostly didn’t need. Ouch.

But here we are now in 2021. There are thousands of alt coins besides just Bitcoin that you can buy. Cryptocurrency isn’t just Bitcoin. It includes several others that now have billion + dollar market caps like Ethereum, Cardano, XRP, and of course, my personal favorite Theta.

Bitcoin is the driver of all of these though, as Bitcoin tends to go, the rest follow (with exceptions of course). But it’s much like the S&P 500 to the stock market. If it goes down as a whole, then it’s likely individual stocks will fall also. Same scenario with crypto for the most part (albeit even more so).

That being said, there are plenty of cryptocurrencies you can invest in. We see the chart above and how it’s recently dropped. Should you invest? Or is this the biggest bubble in history? Let’s get into it.

The Bull Case (Why You Should Invest in Cryptocurrency)

Did you even look at the chart above? Notice the crypto market has basically been halved in the last couple of months. What has happened every other time in history that this happened? Oh yeah, it went to new all time highs (ATHs). Every. Single. Time.

And don’t think the bears (non-believers) weren’t out there before saying you shouldn’t buy cryptocurrency. They’ve been there every step of the way, and they’ve been wrong every step of the way (long-term).

So we’re at a point where crypto has dropped over 50% (now just less than that) from it’s ATH. How is this not a perfect buying opportunity? Cryptocurrency is the future, get in now or get left behind.

Things are different now too. Before it just seemed far too risky for a lot of people…even though had we all taken that risk we could have had life changing money…but anyways, back to the point.

Less Risk Now

We now are seeing institutional adoption like never before. Tesla, Kathy Wood, JP Morgan, Square, PayPal and many others are investing in Bitcoin and there is no reason to believe this won’t increase in the next several years.

In addition to that, El Salvador is now accepting Bitcoin for payment. I don’t think you can really get more bullish news than this. Imagine what happens once other countries start doing the same.

Look, many people believe that it’s basically going to eventually take over as our primary currency. After all our fiat (“normal” dollars) money continues to lose it’s value against inflation.

So how does Bitcoin (and other cryptocurrencies) grow from here? Bitcoin’s market cap is currently around 642 billion dollars after earlier this year breaking a trillion dollars. Can it really grow from here?

Think about it like this, the market cap of gold is just over 11 trillion dollars. That’s what we should be comparing Bitcoin’s market cap to, not corporations.

What do you think is the future? Digital currency? Or bricks of gold? I think there is a very good case to make that Bitcoin will eventually top the market cap of gold. If it were to match gold’s current market cap that is about a 17.5x from here. That doesn’t seem unrealistic at all.

Now, that means $100 would be worth $1750 if Bitcoin hits that valuation. So we’re not talking about the same kind of gains in the next 5-10 years as the last 5-10. But again, at this point it just seems like much less of a risk.

So what if this plays out? If Bitcoin were to take this path and eventually be worth 10 trillion dollars, then that means buying cryptocurrency would likely be the best investment you can make. And forget about just buying Bitcoin.

If you invest in alt coins and pick one that sticks around for the long haul then that’s where you could potentially see gains that seem unimaginable like a 100x or…dare I say, 1000x…

The possibilities are endless, even though crypto has grown massively (especially the last year) doesn’t mean it’s not still in it’s early stages.

The Technology (Code)

Now, notice I haven’t even gotten into the actual blockchain technology. We’ve just simply talked about the value of cryptocurrency, but not what it’s actually doing.

There is quite a bit of diversity in terms of cryptocurrency and this, is entirely it’s own article. And obviously is the biggest question behind all of this. Is the blockchain technology useful enough to lead to these insane market caps we’re talking about here?

You don’t have to have a complete understanding of cryptocurrency to invest in it. If you did, you’d likely have to wait weeks, months, or years to get in.

So I’ll keep this part short. Cryptocurrency is providing a few key things. Number 1 is decentralization. That is the entire idea behind cryptocurrency. It’s getting rid of the middle man so that you no longer have to trust a central bank with your money. Everything is transparent as every transaction ever made can be shown on the blockchain. This is backed a couple of ways, either by proof of work or proof of stake.

In addition to that, smart contracts can be done through decentralized apps (Dapps). Smart contracts could potentially change the way the world on many different fronts. This could be the future of legal contracts, supply chain management, liens, insurance, and who knows, possibly even voting.

Again, you don’t have to understand everything about this to invest and considering there are so many different cryptocurrencies to invest in, it may be a good idea to look into the technology of the specific cryptocurrency you want to invest in, not all can do smart contracts, etc. There are so many different alt coins that provide different values (while some….or most…basically have no use case **cough Doge).

The Bear Case (Why You Shouldn’t Invest in Cryptocurrency)

Just because something has went up in value in the past doesn’t mean that it’s going to do well into the future. And many people believe that since crypto has grown so much, it’s overvalued and due to fall off a cliff.

It’s simply internet monopoly money that isn’t actually providing any value, and at the same time is arguably bad for the environment. I think this video here is a terrific summary of the bear case. It’s a must watch!

Although…he started off completely wrong from the start…maybe he’s unaware of what that $100 investment 10 years ago would have brought you 🙂 But anyways, back to the bear case.

Crypto is a highly volatile investment and you should only invest money you can afford to lose as there is a decent chance you’re just throwing away your money (especially on alt coins), or at least could be for a long time.

Even people who invested in 2018 had to wait years to just make their money back. There is a good chance if you invest now the value will go down-especially in the short term. I mean do you really want to risk your financial future for that?

And where do we go from here? It’s not real money. Do you really expect this to go into the trillions?

The fact of the matter is that China recently banned crypto from being used, or at least financial institutions from providing services related to it. What if that happens worldwide?

At the end of the day the stock market seems like a much safer play, after all, it’s been around a lot longer and has a long term proven track record.

Bitcoin, however, just dropped by over 50% of it’s value in just over a month. Do you really want to play that game? If you’re going to invest why don’t you invest in something making actual products with actual real money?

Is There Any In Between?

The bulls think crypto is the future of our economy and will be used to actually buy products (it already is) and will either replace the stock market or be used as the primary form of currency towards stocks and virtually everything we buy. The bears think crypto is the biggest ponzi-scheme we’ve seen in the history of the world and it’s destined to go to zero.

When we see these extreme differentiations of viewpoints, usually there is just a happy middle right? Maybe the most likely scenario is that Bitcoin doesn’t overtake gold’s market cap of 11.2 trillion over the next 10 years. Maybe it only goes to 3 or 4 trillion in a decade. Fiat currency doesn’t get overtaken and is still the primary source of money. That also seems like a realistic possibility. Who knows. Nobody knows the future.

Why I recently Invested in Cryptocurrency

Why did I recently move over many of my stock investments and add additional investments into cryptocurrency? I’ve went over the bear and bull cases, and the bottom line is that I think the bear case or some version of it is the most likely.

We currently have a pullback of basically half, I see this as a discounted opportunity to buy in the current climate. The upside is simply too great to ignore. Now of course these are seen as “high risk” investments, but the further along cryptocurrency goes the less risk there is (imo).

We all saw the bull market happen and I sure as hell am kicking myself for not investing in 2020 instead of 2021. That being said, I don’t think it’s too late, I think we’re going to see Bitcoin (and other alt coins) reach new ATHs.

Many people in this space feel the bull run is going to continue this year and that we could see Bitcoin go to somewhere between 100k and 200k by early 2022. That is insane. But it just may happen. To me, the potential is too much to turn down.

***update-Bitcoin hit an all time high of 69k but didn’t hit 100k +, it then dropped to currently just above 20k*** 🙂

Most of my 401k is also made up of stocks so this is just the icing on the cake. I’m thinking big picture and with as much as I’m contributing to my 401k each month it will be adding more to the stock market. The 15% range I put myself in is the area I’d personally like to be at currently.

It works well with my situation because of how much I am adding back into the stock market each month going forward (mostly from my 401k).

Final Answer: Should You Invest in Cryptocurrency?

Again, I have to remind you, this isn’t financial advice, this is just my financial opinion. You have to do your own research and ultimately decide if investing in crypto is right for you.

The bottom line is that while there is huge potential, there is also huge risk, especially in the short term, and especially with alt coins. It’s always a good idea to invest money that you don’t need at the moment, especially with highly volatile investments like cryptocurrency. But if you’re willing to take the risk of seeing your money drop in half (or more) to potentially end up with some huge gains into the future. It could very well be worth the “risk” of investing.

In my opinion, there is more risk not investing. But investing at the right time with the right allocations is crucial. At the end of the day though, I think in 5-10 years the entire crypto industry is far higher than what it is now.

What about you? Do you invest in cryptocurrency? Did this article give you any insight on investing in cryptocurrency? Do you think it’s the future of money? Do you think it’s the biggest ponzi scheme known to man? Let me know in the comments below!