One thing I’ve realized after investing for the last couple of years and seeing things swing so drastically is that you absolutely need to have a template to track what you’re doing. Using an excel template as a stock and crypto portfolio tracker is a great way to keep track of not only your profits and losses but the actual allocation of your assets as well.

If you’re wondering what the best crypto and stock market portfolio tracker is, then whatever you decide to go with I think that risk allocation has to be something you include.

Now, before we get into this specific tracker, here’s a quick disclaimer: this isn’t financial advice, the template won’t guarantee you make money, it’s up to you to decide what/how much to invest. You get the idea.

That being said, I specifically created an excel tracker that breaks down your portfolio by 3 different categories: low-risk, mid-tier, and high-risk assets vs your total available “cash” as well as a tab to be able to track all of your trades that tracks all of your short-term and long-term gains/losses.

The tracker is available on Etsy for the cost of a cheap meal at McDonalds.

Now understanding your risk levels and what your portfolio actually looks like gives you an understanding that can allow you complete control and understanding of what you’re investing in (and should be combined with a budget tracker as well).

And let’s be honest, if you’ve been investing recently, you’ve likely gotten completely rekt lately (yes that was purposely spelled that way).

However, if you invested in 2020 you likely made a crazy amount of money, basically the complete opposite of what’s happened this year (2022).

These polar opposites suggest we need to understand how much we have invested based on current markets with our own personal confidence levels.

At the end of the day that’s what we’re doing. We’re placing money on investments we think will be worth more in the future. We don’t want to invest when the market is about to take a downturn and we ideally want to be heavily invested before things take off.

By having a tracker that gives you a portfolio breakdown on risk vs “cash” available, it provides is a situation where we don’t have to “get lucky”. We’re investing based on an understood risk/reward based on our own personal confidence levels.

This is a gamechanger.

Now what do I mean exactly?

What I’m specifically talking about is that we want to buy low/sell high and in a perfect world we would be 100% invested prior to a bull market, and then we would sell 100% at the top right before a bear market (obviously).

Again, perfect world scenario. This never actually happens.

However, we adjust by current market conditions etc. and whatever our confidence levels are. So this can give you a completely personalized approach towards the market.

Portfolio Allocation with Risk Included

What this refers to is having your portfolio set up so that you always have “cash” on hand, and you also understand how much of your portfolio is in different risk areas.

Ultimately, it is up to you what you consider “high-risk” or “low-risk”, that will be completely subjective.

And honestly, in my opinion with today’s current state of the market, I’m not sure there is such a thing as “mid-tier” risk investment.

Now personally, I consider any cryptocurrency to fall under a high-risk category, while safe investments I consider to be certain ETFs, holding companies, or dividend stocks.

It’s all subjective and depends on your own personal risk levels. Someone with higher risk may consider Bitcoin and ETH, or maybe other top crypto currencies as “mid-tier” investments while they only consider low-cap cryptocurrencies high-risk.

If you’re a trader, you could even categorize your trades using this template. Knowing how much “cash” you have invested vs. money you’re allocating for trades is also useful.

You can decide whatever category you consider your investments to fall under.

That being said, let’s look at some examples of how this template works.

Stock and Portfolio Tracker Tutorial

Again, we have 3 tabs where you can enter your investments based on risk, here are some screenshots with example investments entered:

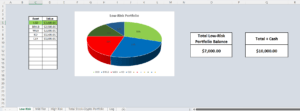

Low Risk Portfolio:

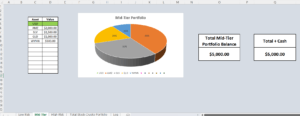

Mid-Tier Portfolio:

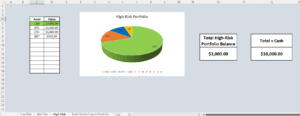

High-Risk Portfolio:

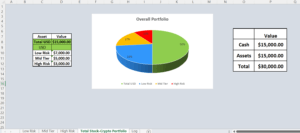

Total Stock/Crypto Portfolio:

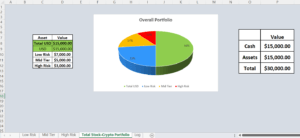

As you can in the example here there is a total portfolio of $30,000 with $15,000 of that allocated towards investments and $15,000 allocated towards available “cash”.

We have this broken down under the 3 different risk categories to get that total, and tracker does all of the calculating for you to give you your overall portfolio.

Of course, everyone’s portfolio will look completely different. Some people may only have $1,000 invested while others may have $100,000 plus, either way this gives us a tool to understand how much we have invested and what our risk levels are.

Just add in whatever your investments are.

The reason I created it this way is because it’s something that I personally wanted to use, but not only that it’s something that so many retail investors could benefit from.

The average retail investor has gotten absolutely shredded investing in 2022 as we’ve seen anything high-risk just get absolutely obliterated.

Seeing people have their investments completely in high-risk assets with very little cash on the sidelines makes something like this an absolute must for any retail investor, especially if you’re investing in cryptocurrency.

That being said, with the above example notice I used cash available within each category of risk. You don’t have to do it this way, however. If that isn’t something you want to do you can just add it in to the “USD” category on the total portfolio section tab.

That would make your sections look like this instead:

As you can see in the example, this is the “mid-tier” investments with no cash added.

This way you can see your full portfolio of just your assets and could then just add any available cash you have under the “USD” (D9) cell in the Total Stock-Crypto Portfolio tab.

With the same example used where a total portfolio is 30k, 15k being assets, 15k being cash it would look like this:

As you can see you can just add in your overall available “cash” there instead to get the same result, the “Total USD” calculates it from a formula.

This method may very well be the way most people use it, I just personally like allocating my cash within each risk section. This means separate bank accounts or money available on trading platforms (although be aware of the risk involved with exchanges!)

Either way, you can control how you want to see your asset allocation and can also add any available capital in whichever area works for you.

That’s basically it for the main tabs, leaving us with just the log of all of our transactions.

Portfolio Log

If you’re buying and selling assets then you have to pay taxes on your gains, and you can offset your losses as well. That being said, this last tax season was a nightmare for me to calculate all of my crypto trades.

Some of these platforms will you give you your overall gains/losses but a lot of them don’t. That’s why this is vitally important to be able to easily track.

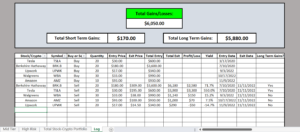

Here’s an example of what the log will look like:

To make this simple we just used 5 different companies for buys and sells. As you can see the tracker will break down your gains and losses by short term or long term.

All you have to enter is the symbol quantity, the enter price, the exit price (if selling), and add in the dates and it will you output all of these numbers for you. Obviously, you’ll need to add the symbol as well.

FAQ

Why is there only 11 different spots for assets on each risk tab (33 total)?

Great question, the reason I only added 11 spots for different investments is because if you’re going beyond that you probably are invested in too many assets.

How can you really understand what you’re invested in if you’re invested in more than 30 companies? Warren Buffet said it best, check this out:

Interesting, so diversifying in a lot of companies is nonsense, and you should just pick a few companies and roll with those…ok. Interesting. Who am I to say Warren Buffet is wrong.

Granted, during the last crypto bull run you might have actually just done better randomly spreading out your funds to 20 different coins (as long as you sold!).

For example, as opposed to putting 10k in one crypto and 10k in another, putting 1k into 20 different coins. This sounds crazy but crypto doesn’t always make sense. For the record Buffet is also anti-crypto.

Anyways, the point is you can still do that if you really want to. Just categorize them. So with the above example of 20 different coins, you could just categorize them as a “crypto blend” or something like that.

At the end of the day, using 11 assets per risk level and 33 total was done strategically.

Why doesn’t it have categories for risk and/or trading on the log section?

This template is designed primarily as an investment portfolio tracker and isn’t designed for trading however you can still use it for that.

It doesn’t have sections for shorting or longing etc., just for buying and selling however you could still use your overall buys vs selling to get the same output.

As far as the risk tabs, you can also categorize your trading strategies under risk sections as well. It’s also important to keep a lot of capital on hand for trading as so it’s still relevant if you want to use it for that.

Can I change the formulas? Or what if I accidentally delete the formulas?

All formulas are locked and unable to be edited so you won’t have to worry about accidentally deleting them.

Summary

That’s basically it. As a retail investor, I don’t think you need much more than what’s included in this tracker. Personally, I needed a stock/crypto portfolio tracker and that’s why I created this.

This was designed specifically because I held onto high-risk assets too long and made a lot less money than I otherwise would have if I had a tracker like this to begin with.

Many “blue collar” average Joes can relate.

Again, this is designed with the retail investor in mind. If you’re investing in higher-risk assets, you really need to understand what your portfolio looks like.

I hope you found this article and template useful. Thanks for reading!